|

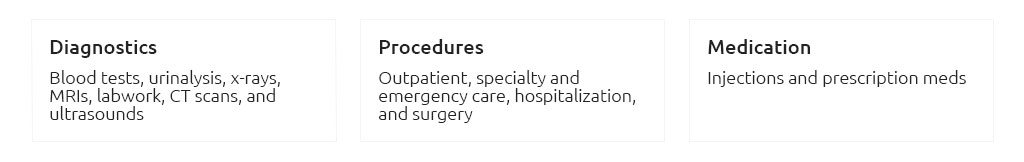

dog pet insurance nyc: a clear framework for steady, sensible choicesWhat "coverage" really means hereCity life concentrates risk. Stairs, sidewalks, subways, crowded parks, and winter salt add small hazards that add up. Before price, make terms concrete. - Accident: injuries from slips, bites, cars, or ingesting street trash.

- Illness: infections, GI issues, ear problems, chronic diseases.

- Hereditary/orthopedic: hip dysplasia, cruciate, IVDD - check waiting periods and bilateral clauses.

- Exam fee inclusion: some reimburse treatment but not the exam; this matters in NYC where exams are pricey.

- Prescription meds and rehab: ask about PT, acupuncture, and Rx food limits.

You might be tempted to compare premiums first. Actually, flip that: define the coverage you won't compromise, then let price sort the finalists. What drives price in NYC- Breed and age: orthopedic and cancer risk push rates upward with time.

- Zip code: Midtown isn't the same as Bay Ridge; clinic fee structures differ.

- Annual limit: $5k, $10k, or unlimited; higher limits raise stability more than they raise cost, up to a point.

- Deductible type: annual vs per-incident; annual is simpler for chronic issues.

- Reimbursement: 70 - 90%. 80% is a common balance.

- Waiting periods: shorter isn't always better if exclusions expand - read the trade-offs.

A simple selection path- Shortlist three policies that clearly cover accidents, illnesses, hereditary, and exam fees.

- Set guardrails: monthly budget ceiling, minimum annual limit, and preferred deductible.

- Check exclusions: bilateral language, dental illness, behavioral care, and Rx food caps.

- Claims mechanics: app submission, average payout time, and direct-pay availability (rare).

- Rate behavior: past renewal increases and how changes are communicated.

Deductible and limit pairingFor most city dogs, an annual deductible of $250 - $500 with a $10k limit covers typical ER swings. Unlimited sounds excessive; for some breeds, it isn't - orthopedic cascades can climb fast. Reimbursement math, fastExample: a $6,000 foreign-body surgery in Manhattan with 80% reimbursement and a $500 annual deductible. You pay $500, insurer covers 80% of the remaining $5,500 = $4,400; your total is $1,600. A cruciate repair at $5,500 looks similar, but rehab can add $600 - $1,200 - only covered if the policy says so. NYC moments that test a policyAt 8:10 a.m. in Astoria, your dog skids on salted ice, won't bear weight, and you head to an ER clinic. You file the claim on the subway home. Most insurers reimburse within a week - correction, during busy stretches it can be closer to two or three. Direct pay is uncommon; expect to pay upfront and be reimbursed. Read these clauses closely- Waiting periods for orthopedic issues and how bilateral knees are treated.

- Pre-existing definition: lookback window and curable vs incurable stance.

- Exam fee coverage and after-hours surcharges.

- Dental illness: not just trauma.

- Behavioral and alternative therapies: covered, capped, or excluded.

Stability and service signalsPrefer insurers with consistent claim turnaround, clear policy language, and steady renewal practices. Underwriters matter, but so do people: responsive support reduces friction when you're stressed. Red flags- Annual increases that routinely exceed 20% without explanation.

- Shifts in core definitions at renewal rather than price alone.

- Vague pre-authorization rules for big surgeries.

Quick heuristics by life stage- Puppy: higher-risk accidents; annual deductible $250 - $500, limit $10k, 80% reimbursement.

- Adult (2 - 7): keep $10k - unlimited if a large or athletic breed; consider 70 - 80% reimbursement to manage premium.

- Senior: predictable chronic care - annual deductible, exam fee inclusion, and rehab coverage matter more than hitting 90% reimbursement.

Lower cost without hollowing coverage- Choose an annual deductible one step higher rather than slashing the annual limit.

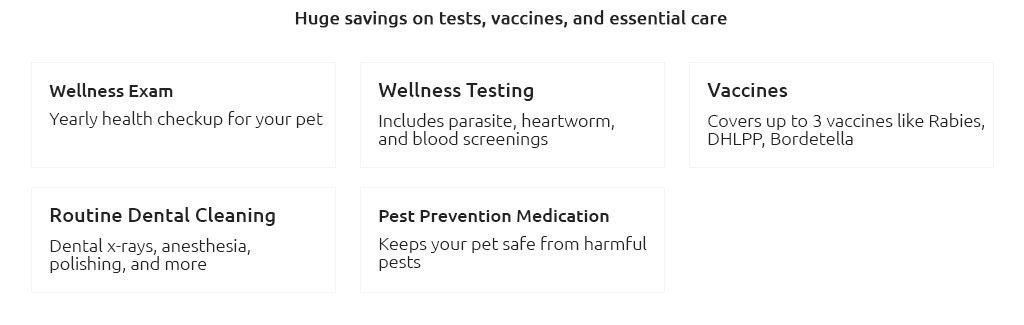

- Drop wellness add-ons if you can budget routine care; they're prepayment, not insurance.

- Pay annually if the discount is real; some offers are negligible.

- Ask about multi-pet or employee benefits programs.

A brief checklist before you buy- Does it cover exams, ER surcharges, and rehab?

- Any breed-specific orthopedic waiting periods or bilateral limits?

- How fast are claims paid in peak seasons?

- What were the last two years' renewal increases?

- Is pre-authorization required for big-ticket procedures?

Select for clarity first, stability second, and price right behind. That order may seem conservative. In NYC care, it's simply practical.

|

|